Where’s the Next Charging Pile in Pakistan – Startup Pakistan

“By 2030, up to 50% of all cars sold in Pakistan will have some form of electrification in line with global targets,” told a spokesman for BYD Pakistan, a joint venture between Chinese EV magnate BYD and Pakistani auto group Mega Motors.

Just last month, BYD announced its entry into the Pakistani market, with BYD Pakistan launched three models for sale as well as plans to open an assembly plant in the country in early 2026.

Kamran Kamal, CEO of HUBCO, the parent company of Mega Motors, stressed in an interview, “I think the conversion rate of NEVs will be as high as 50% by then.”

Yet, Muhammad Abrar Polani, automotive industry analyst at Arif Habib Limited, emphasized that a 30% penetration rate of NEVs in this country by 2030 is achievable, but achieving a 50% target may be more challenging due to infrastructure barriers. In response, the Pakistani government plans to take incentives to meet the challenge. As the Pakistani government is considering providing affordable electricity for electric vehicle charging stations, the country’s Ministry of Power has begun drafting standards for electric vehicle charging stations.

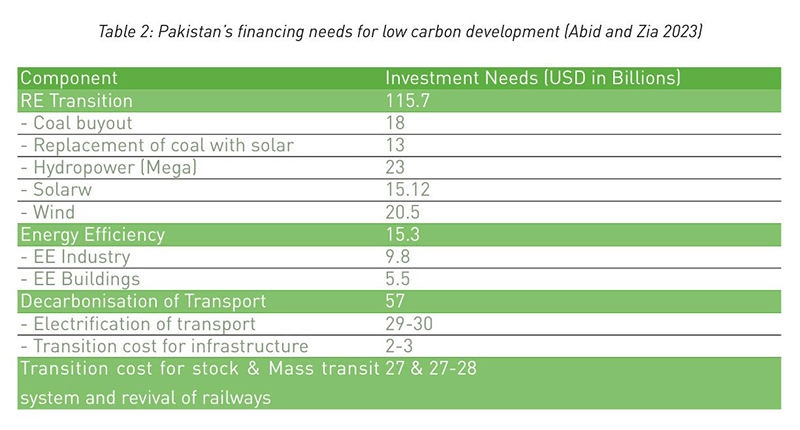

A report titled Low Carbon Development in Pakistan: Opportunities and Challenges for Chinese Private Sector lately released by the Sustainable Development Policy Institute (SDPI) showed that it will cost about USD 57 billion to achieve the overall decarbonization of Pakistan’s transportation industry, of which USD 29-30 billion will be needed for the electrification of transportation vehicles, and USD 2-3 billion for the construction of supporting infrastructure.

Pakistan’s financing needs for low carbon development

According to the report, the expanding Electric Vehicle (EV) market in Pakistan offers promising opportunities for Chinese investors, particularly in alignment with CPEC’s focus on business-to business engagements. Additionally, the short-term uptake of EVs in Pakistan presents opportunities for local manufacturing, particularly in the electric two-and three-wheeler segments, and for establishing charging infrastructure.

“The global electric vehicle (EV) market is experiencing exponential growth with projections indicating an increase from 11.3 million in 2020 to 51.7 million by 2025, and a staggering 144.3 million by 2030 (International Energy Agency 2024).

Similarly, Pakistan shows immense potential for EV adoption, supported by initiatives such as the National Electric Vehicle Policy 2019 (EV Policy) and the Auto Industry Development and Export Policy 2021 2026 (AIDEP).”

Under the AIDEP, manufacturers are offered a comprehensive array of fiscal incentives aimed at supporting the EV manufacturing sector. These incentives include customs duty reductions on EV-specific parts, fixed sales tax rates for locally manufactured two and three wheelers, and waivers of sales tax at the import stage for electric two and three-wheelers. Additionally, import tariffs for electric buses, trucks, and prime movers are set at a mere one per cent. Such incentives are not only attractive for manufacturers but also for consumers, especially considering that import duties on non-electric vehicles in Pakistan can soar up to 300 per cent for luxury vehicles.

Apart from charging piles, another important equipment, batteries, has also become a key area for Chinese companies to target this South Asian market. Not long ago, Hexing Electrical Group, a prominent Chinese business conglomerate, has announced its plans to establish a manufacturing facility in Pakistan’s renewable energy sector. The plant will focus on producing inverters and batteries, marking a significant milestone as the first of its kind in the country.

Minister for Privatization Abdul Aleem Khan warmly welcomed the investment plan. Transferring new energy industries from China to Pakistan, he added, would be a significant step towards enhancing related industrial growth.

Source link