Uber-backed e-scooter start-up Lime enters Japan after Korea exit

Uber Technologies-backed Lime is entering Japan’s growing e-scooter ride market in a foray that pits the San Francisco-based start-up against home-grown Luup.

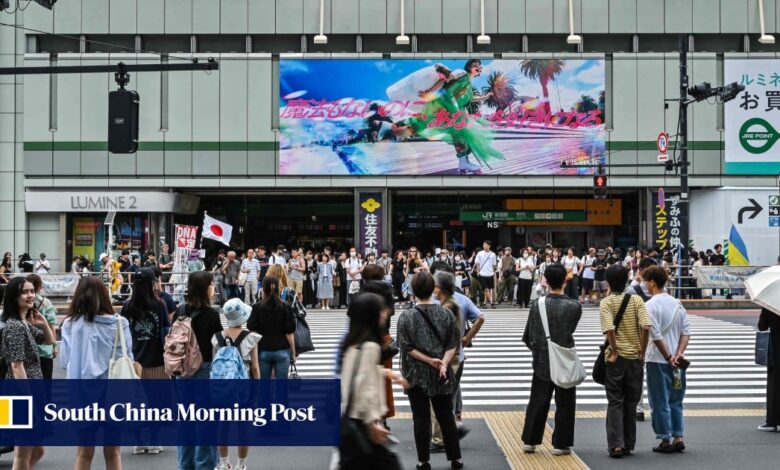

Lime, which has a global fleet of around 200,000 e-bikes and scooters, on Monday launched its service in some of Tokyo’s most densely populated neighbourhoods of Shibuya, Shinjuku, Meguro and Setagaya wards. Lime now has around 200 electric scooters and more than 40 recharging ports. Tokyo-based Luup, which controls more than 90 per cent of the domestic market in terms of ride mileage, operates 9,100 ports.

“We’re starting small,” Lime Chief Executive Officer Wayne Ting said in an interview. “We want to grow slowly with the city and really earn the trust of local regulators and city officials.”

Lime’s entry in Japan is the latest sign of the country’s belated acceptance of the sharing economy, thanks in part to years of dialogue between Luup and regulators, local governments and police. The e-scooter market is expanding in Japan, in contrast to slowdowns elsewhere, as cities impose tougher restrictions or outright bans to deal with abandoned e-scooters clogging pavements.

Japan’s government, which for years stonewalled the likes of Uber and Airbnb, was slow to allow shared e-scooter rides. It instead set up regulations requiring riders to park in designated charging ports and abide by local traffic rules, including lower speed restrictions on pavements. Once those restrictions were in place, it then passed a new traffic law doing away with helmet and license requirements for e-scooter users last year, clearing a major hurdle to growth.

To meet the regulations, Lime negotiated with local government officials and partners to set up ports, a task that took 6 to 12 months. It also modified its e-scooters: It added indicators, installed slower six kilometre-per-hour riding modes, shortened the handlebar length and repositioned bells.

But the country’s clear industry framework was a big incentive for entry, according to a spokesperson of the company, which retreated from South Korea in 2022. Lack of regulatory clarity there opened doors for rivals and the resulting competition ate into margins, according to Ting.

“The last thing we want to do is grow too fast and make you feel like it’s a nuisance,” Ting said, noting that Lime’s fleet includes seated scooters. “Our intention over time is to grow throughout the Tokyo metropolitan area and potentially even look at broader Japanese opportunities.”

Lime, in which Uber held a roughly 29 per cent stake late last year, is expanding even as its rivals in the US have struggled to stay afloat as interest rates rise and easy venture-capital money dries up. Lime had a valuation of about US$510 million in 2020 when Uber led a US$170 million investment round, Bloomberg reported. That figure “seems outdated,” Ting said, adding that Lime has turned profitable since then. The company reported adjusted earnings before interest, taxes, depreciation and amortisation of more than US$90 million in 2023.

“We’d love to be a major transportation product for Japanese people in the course of the coming years,” Ting said.

Source link