China EV battery race: Tesla’s rivals join NIO in efforts to achieve 1,000km driving range on single charge target

Their new weapon is the solid-state battery, deemed a better option because the electricity from solid electrodes and a solid electrolyte is safer, more reliable and more efficient than the liquid or polymer gel electrolytes found in existing lithium-ion or lithium polymer batteries.

“A battery that can power for 1,000km on a single charge will be of great significance to the EV segment,” said Wang Bin, a Credit Suisse analyst. “Range anxiety has long been a stumbling block to the rise of EVs, and the industry now sees a ray of hope from these new batteries.”

Following closely, Shanghai-based Zhiji Motor announced that it was working with China’s biggest producer of automotive batteries Contemporary Amperex Technology Limited (CATL) to develop a silicon-doped lithium supplement battery cell with a 1,000km driving range.

Zhiji is a premium electric-car model jointly developed by General Motors’ Chinese partner SAIC Motor, Shanghai city’s hi-tech development park and this newspaper’s owner Alibaba Group Holding.

Later in January, GAC Group is expected to unveil the test result of a range of batteries enhanced with the carbon allotrope graphene, which the Chinese assembler of Toyota and Honda cars said can go as far as 1,000km on a charge.

The new goalpost would extend the furthest range of Tesla’s Model Y Long Range version by two-thirds if the solid-state batteries live up to expectations. That would be a game changer for an industry where one in every five cars on China’s roads, equivalent to 4 million vehicles, will be powered by electricity by 2025.

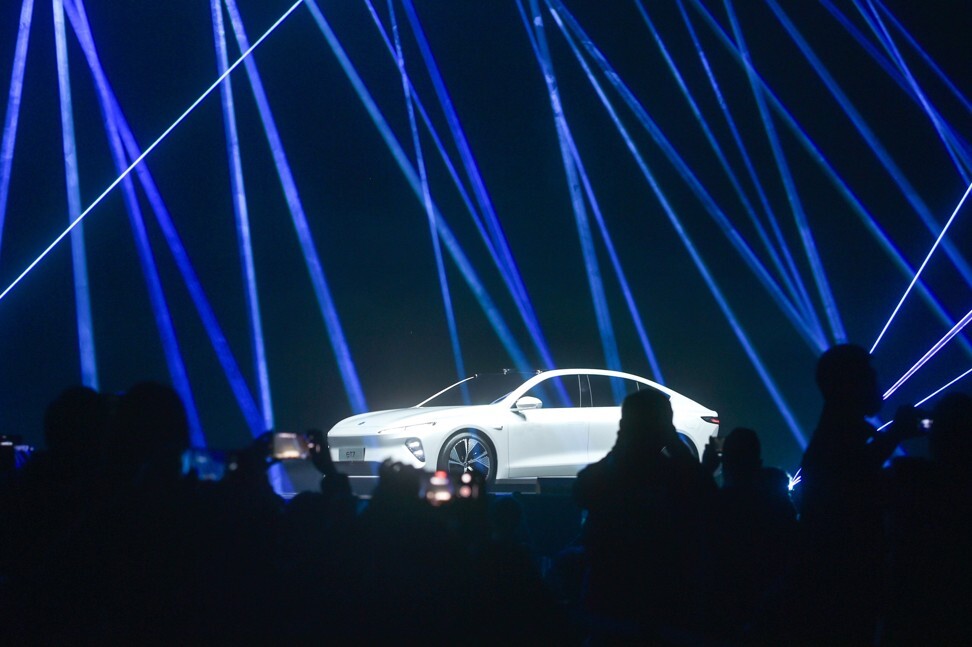

“We are building premium EVs that can [displace] cars driven by internal combustion engines (ICE) such as BMW’s X3 SUVs among wealthy drivers,” said William Li Bin, chairman and founder of the six-year-old start-up backed by Tencent Holdings. “Battery cost will make our cars more expensive than the ICE competitors, but we want to promote our battery-as-a-service (BaaS) model to make the cars more attractive.”

The BaaS business model allows customers to buy an electric car while subscribing to a separate battery-leasing plan for a fee to help lower the upfront cost of owning an electric car by about 20 per cent.

The total cost of an electric car could decline to match a petrol-guzzling vehicle of the same segment by 2024, according to Credit Suisse’s Wang, which would spark a new round of buying euphoria, as drivers no longer have to pay a premium to cut gaseous emissions.

China’s sales of new-energy vehicles, as electric cars are classified under, jumped 12 per cent to 1.17 million units last year, even amid the consumption slump during the coronavirus pandemic, making up 6 per cent of all vehicles on the country’s roads.

Increasing penetration of electric cars and their wider acceptance, helped in no small part by further driving range and affordability, could spur 2021 sales by at least 40 per cent, according to an estimate by China’s automotive industry officials.

NIO claims it will be the first carmaker worldwide to adopt a solid-state battery, without disclosing the name of supplier.

CATL and Jiangsu-based Chingtao Energy would be its partner in developing the battery, according to sources. CATL would not comment on the issue while Chingtao was not available for comment.

“The battery industry is moving up the value chain with new technology and products amid the cascading demand from carmakers,” said UBS analyst Paul Gong. “When [the technology of] the solid-state battery matures, it is safe to say that more new models by a variety of car brands will use it.”

Source link