China boosts semiconductor production in 2020, but imports keep apace, frustrating self-sufficiency goals

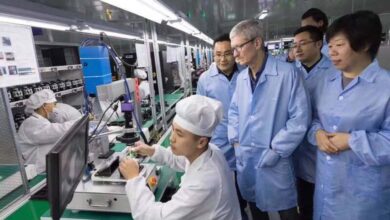

China’s production of integrated circuits and industrial robots surged in 2020, as the country boosted its output of hi-tech products amid tighter US restrictions, according to official industrial statistics. A similar growth rate in imported chips, however, suggests China remains far from its goal of self-sufficiency in the critical technology.

The country’s output of integrated circuits surged 16.2 per cent in 2020, a sharp acceleration from the 7.2 per cent rise in 2019. Industrial robot production also increased, jumping 19.1 per cent. New energy vehicles were another bright spot, with production expanding 17.3 per cent from last year.

“Industrial automation or smart factories, new energy vehicles and semiconductors that can help power next-generation technologies in all areas are among the most critical national objectives in the 14th five-year plan,” said Edison Lee, an equity research analyst for telecoms services at Jefferies Asia.

The US restrictions also came amid rising demand for chips in 2020. The Covid-19 pandemic resulted in supply shortages as factories closed and remote work drove up demand for online services and the gadgets that make them accessible, Lee said. In addition to the new chip restrictions, China’s nationwide upgrade to 5G networks also drove companies to increase their chip inventories.

China’s semiconductor industry will continue to grow in 2021, Lee said, as the country expands capacity for its chip fabrication plants. The self-reliance push could also help support other industries, he noted, including new energy vehicles, autonomous driving and industrial automation.

However, the NBS numbers alone paint a skewed picture of China’s semiconductor industry, according to Stewart Randall, head of electronics and embedded software at business consultancy Intralink. He noted the rise in imports along with domestic production of integrated circuits as an area where China has fallen short of its goal.

“The original target for 2020 was 40 per cent self-sufficient, but China has completely failed at that target,” Randall said.

Technological self-sufficiency is one of the main themes of China’s latest five-year plan, which identifies policy priorities for keeping the economy growing. High technology is a key factor in managing the fast-changing international environment, said Wang Zhigang, minister of science and technology, during the introduction of the plan in late October.

Other statistics from the NBS include the value added in China’s hi-tech manufacturing industry, which rose 7.1 per cent, and the equipment manufacturing industry, which rose 6.6 per cent in 2020, roughly 4 percentage points faster than for other large-scale industries.

Investment in hi-tech industries increased by more than 10.6 percentage points compared with the previous year, the bureau said.

Source link